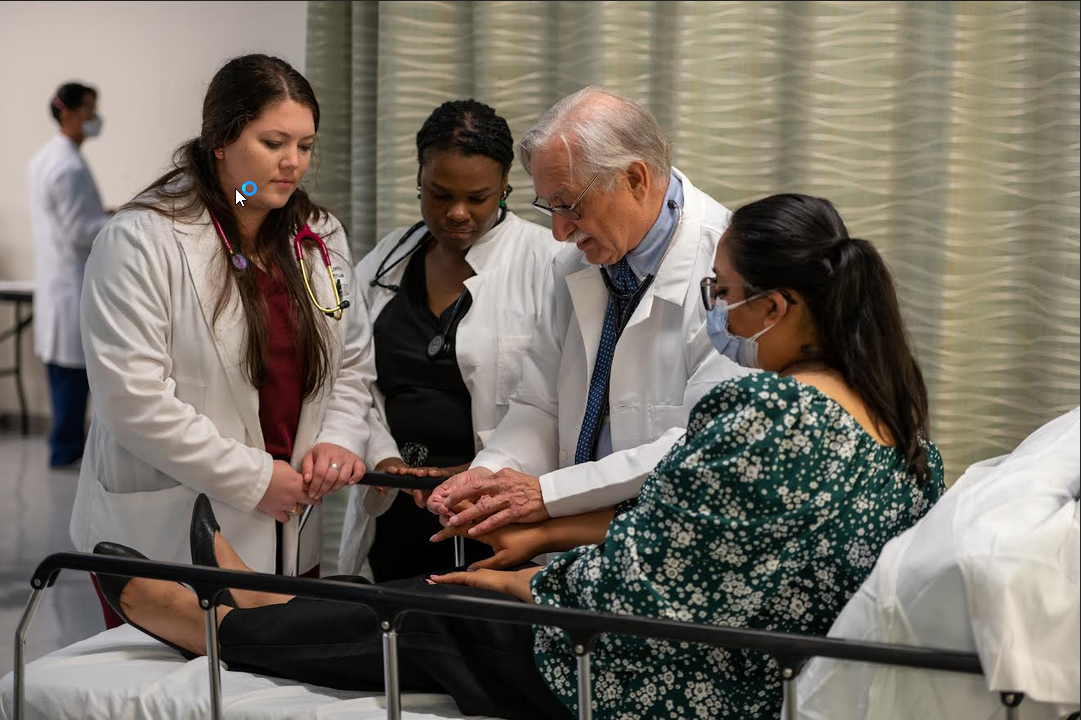

​Digit Insurance that has been awarded the 'General Insurance Company of the Year 2019' in Singapore by Asia Insurance Review Awards, has been named the Fastest Growing General Insurance Company in the world and has earned the trust of 50 lakh customers in less than 2 years with a 1% market share (Q2 FY2019-20), has fortified their product portfolio with the launch of retail "Digit Healthcare Plus". The uniqueness of this launch is that the benefits in this health insurance product have been customized for different age groups and their health needs, along with the help & approval of an Ex-AIIMS Director.

With this customisation, millennials who are fond of Do-It-Yourself products can choose benefits, depending on their needs. Digit's DIY Health Insurance, therefore, breaks away from the norm of standard plans with the same benefits for all age groups.

Also being true to its mission of simplicity, Digit collaborated with 15-year old kids and sought their help to simplify the health insurance documents so that the coverages and exclusions are explained in simple terms without jargons and is easy to read and comprehend.

Key Product highlights: Option for additional sum insured for Accidental Hospitalization and Critical Illness over and above Base Sum Insured Sum Insured Refill benefit/ Restoration benefit that makes sense for big families with a Family Floater Health Insurance Flexible co-payment options, irrespective of age No limit on room rent i.e. no restriction on room type Maternity cover that covers new-borns till 90 days with WHO-approved vaccination for five years that makes sense for going families Home hospitalization and alternate treatments (AYUSH) option that makes sense for seniors Zone-based health insurance pricing enabling lower prices for non-metro cities that have lower medical costs Option to cover bariatric surgery and treatment for psychiatric illness Simple claims process along with Advance Claim Settlement for Planned procedure.

Mr Kamesh Goyal, Founder and Chairman, Digit Insurance, said, “Health Insurance is usually offered as a one size fits all cover with standard products. At Digit, we wanted to reimagine this, change this, simplify this by looking at the health needs of different age groups and customising the benefits accordingly, almost like a DIY Health Insurance wherein people can choose the coverages that make sense to them. To help us further in this relevance check, we also roped in doctors, including an Ex All India Institute of Medical Sciences (AIIMS) Director. We did so as we felt that doctors spend a lot of time with people in different life-stages and they know what kind of health insurance benefits are relevant for them."

With this customisation, millennials who are fond of Do-It-Yourself products can choose benefits, depending on their needs. Digit's DIY Health Insurance, therefore, breaks away from the norm of standard plans with the same benefits for all age groups.

Also being true to its mission of simplicity, Digit collaborated with 15-year old kids and sought their help to simplify the health insurance documents so that the coverages and exclusions are explained in simple terms without jargons and is easy to read and comprehend.

Key Product highlights: Option for additional sum insured for Accidental Hospitalization and Critical Illness over and above Base Sum Insured Sum Insured Refill benefit/ Restoration benefit that makes sense for big families with a Family Floater Health Insurance Flexible co-payment options, irrespective of age No limit on room rent i.e. no restriction on room type Maternity cover that covers new-borns till 90 days with WHO-approved vaccination for five years that makes sense for going families Home hospitalization and alternate treatments (AYUSH) option that makes sense for seniors Zone-based health insurance pricing enabling lower prices for non-metro cities that have lower medical costs Option to cover bariatric surgery and treatment for psychiatric illness Simple claims process along with Advance Claim Settlement for Planned procedure.

Mr Kamesh Goyal, Founder and Chairman, Digit Insurance, said, “Health Insurance is usually offered as a one size fits all cover with standard products. At Digit, we wanted to reimagine this, change this, simplify this by looking at the health needs of different age groups and customising the benefits accordingly, almost like a DIY Health Insurance wherein people can choose the coverages that make sense to them. To help us further in this relevance check, we also roped in doctors, including an Ex All India Institute of Medical Sciences (AIIMS) Director. We did so as we felt that doctors spend a lot of time with people in different life-stages and they know what kind of health insurance benefits are relevant for them."

Digit Insurance goes DIY route for Millennials.

Digit Insurance goes DIY route for Millennials.

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)