"The fundamentals of GSK’s business remain strong and we are maintaining good momentum on our strategic priorities. This quarter, we presented promising data and had positive regulatory reviews for new speciality pipeline medicines to treat HIV and Oncology; and made further progress with our Consumer Healthcare integration and Future Ready programmes, both of which will prepare the company for separation," said Emma Walmsley, Chief Executive Officer, GSK while declaring the results.

“We continue to believe that multiple options will be needed to prevent and treat COVID-19 and are working at pace with our partners to develop potential adjuvanted vaccines and therapeutics to fight the virus. At the same time, we have made strategic investments in next-generation vaccine and antibody technologies, most recently through our new collaboration with CureVac.

“As expected, our performance this quarter was disrupted by COVID-19, particularly in our Vaccines business, as visits to healthcare professionals were limited due to lockdown measures. Overall, we are seeing good underlying demand for our major products and are confident this will be reflected in future performance when the impact of COVID measures eases.”

Financial and product highlights

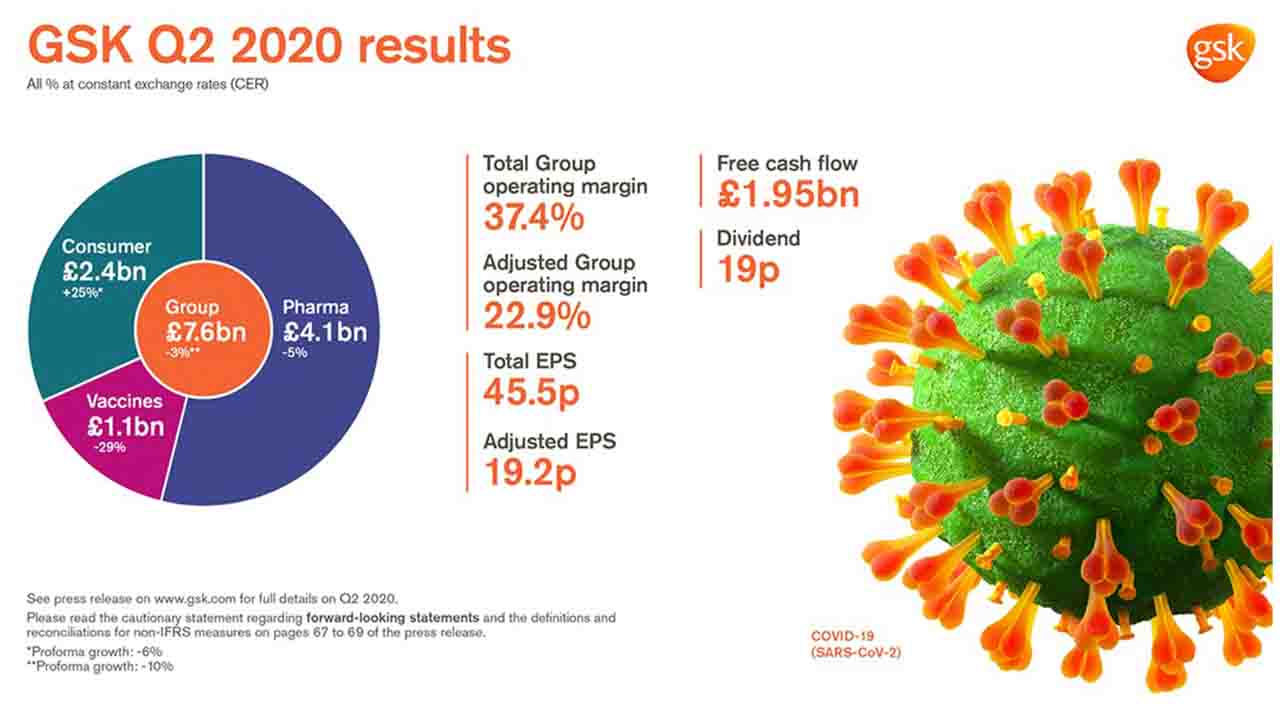

Reported Group sales £7.6 billion -2% AER, -3% CER (Pro-forma -10% CER*; -8% CER excluding divestments/brands under review). Pharmaceuticals £4.1 billion -5% AER, -5% CER; Vaccines £1.1 billion -29% AER, -29% CER; Consumer Healthcare £2.4 billion +25% AER, +25% CER (Pro-forma -6% CER).H1 Reported group sales £16.7 billion 8% AER, 8% CER (Pro-forma flat CER*; +1% CER excluding divestments/brands under review)

Sales decline in Q2 2020 reflects expected disruption from COVID-19, particularly in Vaccines as well as destocking from Q1 2020 in Pharmaceuticals and Consumer Healthcare

Total Respiratory sales £883 million +17% AER, +16% CER. Trelegy sales £194 million +62% AER, +58% CER. Nucala sales £241 million +24% AER, +21% CER

Total HIV sales £1.2 billion, -2% AER, -3% CER. Dolutegravir sales £1.1 billion, -1% AER, -2% CER, two-drug regimen sales £181 million, >100% AER, >100% CER (Dovato sales £68 million, >100% AER, >100% CER, Juluca sales £113 million, +35% AER, +33% CER)

Shingrix sales £323 million, -16% AER%, -19% CER

Total Group operating margin 37.4%. Adjusted Group operating margin 22.9%, reflecting lower sales and growth in investment in R&D

Total EPS 45.5p; >100% AER, >100% CER reflecting profit on disposal of Horlicks and other Consumer Healthcare brands

Adjusted EPS 19.2p -37% AER, -38% CER reflecting lower sales and higher non-controlling interests following creation of the Consumer Healthcare JV in 2019 and a higher tax rate

Q2 net cash flow from operations £2.76 billion. Free cash flow £1.95 billion

19p dividend declared for the quarter

Guidance

Guidance for 2020 Adjusted EPS maintained; outcome is dependent in particular on timing of a recovery in vaccination rates

Pipeline highlights

Continued strengthening of the biopharma pipeline which now contains 35 medicines and 15 vaccines; over 75% of pipeline assets are focused on immunologyThree approvals in Q2: Zejula in ovarian cancer, Rukobia in HIV, Duvroq in anaemia (Japan). Expect further approval decisions for assets in Oncology and Respiratory

HIV

Cabenuva resubmitted in the US as HIV treatment; regulatory decision anticipated Q1 2021

Data showing superiority of long-acting cabotegravir versus Truvada in PrEP presented at IAS

FDA approval of Rukobia as first-in-class treatment for adults with few treatment options available

Oncology

Zejula approved by FDA for first line maintenance treatment in ovarian cancer in all comers regardless of biomarker status

Positive European CHMP opinion for belantamab mafodotin in multiple myeloma; FDA AdCom voted in favour (12-0) of risk-benefit profile with approval decision anticipated in August

Respiratory

Nucala granted priority review by FDA for hypereosinophilic syndrome (HES). Decision expected H1 2021

Vaccines

New positive Phase II data received for RSV vaccine for maternal and older adults. Data to be presented at upcoming scientific congress. Phase III study start in maternal adults planned for H2 2020

Strategic collaboration announced with CureVac on mRNA technology

GSK reports their firs quarter 2020 results

GSK reports their firs quarter 2020 results

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)