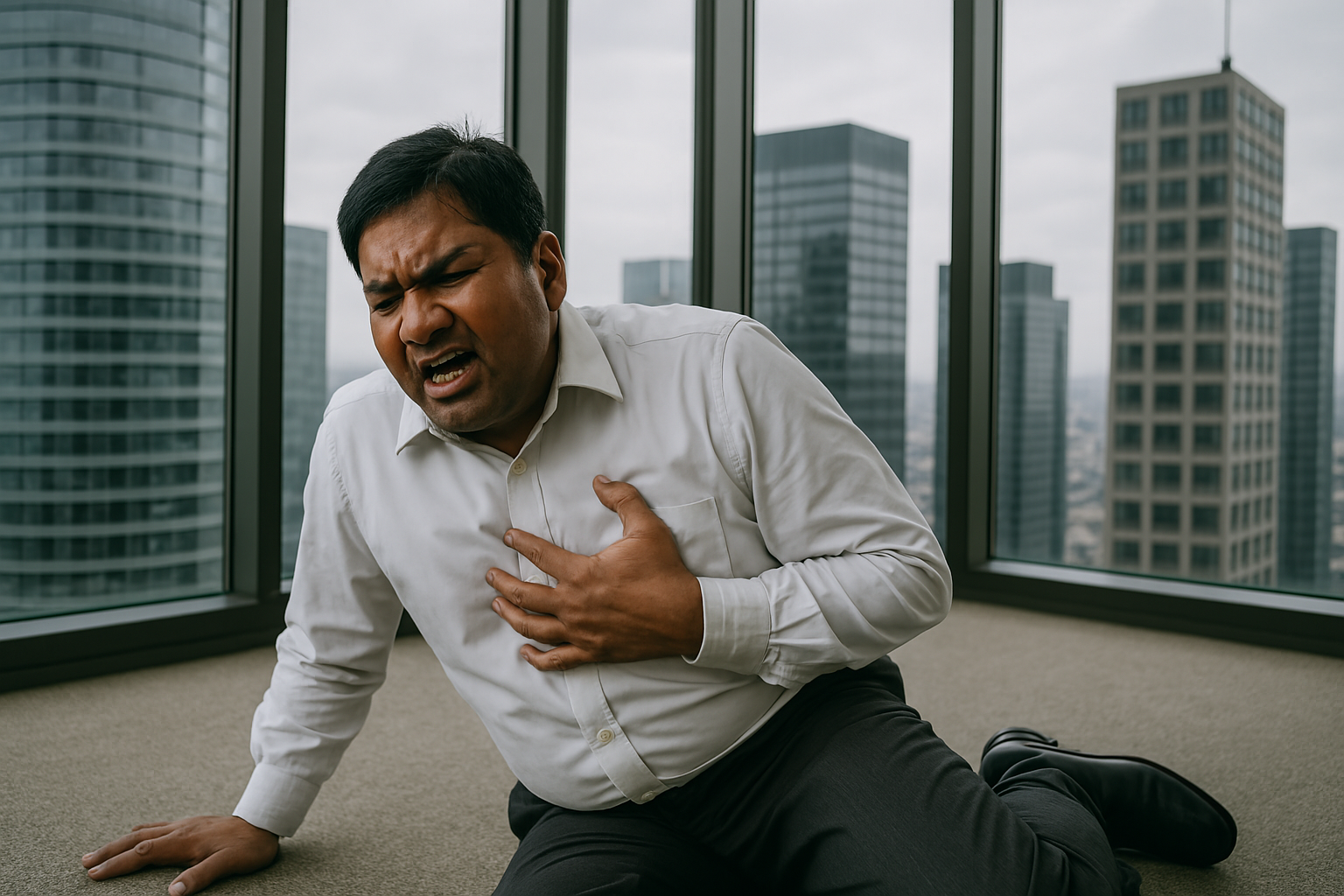

The funds allocated towards healthcare by the 2020 Union Budget were 5.7% lower than the amount apportioned last year. This combined with the fact that healthcare inflation in India is believed to be increasing at double the rate of retail inflation and that about 56% of Indians don't have any health insurance reveals the stark nature of healthcare finance in the country. To address this deficiency and make medical care more accessible and hassle-free, Bajaj Finance Limited, the lending and investing arm of Bajaj Finserv, offers a Digital Health EMI Network Card.

This card offers medical financing up to Rs.4 lakh and is 100% digital thus providing instant activation. It allows customers to split hospital or pharmacy bills into No Cost EMIs up to 24 months and thus get the treatment and medicines they need without any hassles. With zero paperwork or requirement for documents and an instant activation process, the Digital Health EMI Network Card makes it easy and convenient to finance health-related costs without going over budget.

Read on to know how this card combines digital convenience with access to healthcare.

High-value EMI financing brings medical care within reach

As Indian healthcare is transforming for the better with high-tech gadgets and R&D, the resulting costs for professional health treatments have become expensive. Addressing this, the Digital Health EMI Network Card offers credit of up to Rs.4 lakh for a wide range of medical treatments offered by top healthcare institutions at more than 1,000 cities across the country.

Access to 5,500 healthcare partners and 800+ treatments

Dental care, cardiology, cosmetic surgery, orthopaedics, oncology, hair treatment, stem cell banking, slimming treatment and more are available to customers using the Digital Health EMI Network Card. These are available through Bajaj Finserv's lifecare partners, which includes multispecialty hospitals, non-multispecialty hospitals, diagnostic centres, pharmacies and more. Notable names in this healthcare network include Ruby Hall Clinic, Apollo Hospitals, and Manipal Hospitals.

Repayment over a flexible tenor reduces stress on personal finances

The Digital Health EMI Network Card allows customers to divide medical bills into pocket-friendly EMIs payable over up to 24 months. This makes it easier to get treatment or buy medicines without compromise or hesitation. Customers can choose a repayment tenor that suits their pocket and thus maintain their personal finances.

Fast and fully digital activation increases convenience

Existing Bajaj Finserv customers can get the card now through a simple and paperless process. All they need to do is apply online using their registered mobile number and OTP and pay the joining fees of Rs.707. This makes it easier to address urgent medical needs without wasting time. New customers can also get the card when they avail treatment from Bajaj Finserv's lifecare partners.

Value-added features boost utility and save money

To help extend the benefit of the card to family members and their medical needs, customers can use the card not only for themselves, but also their parents, spouse, siblings and children. In addition, customers get a complimentary personal accidental cover of Rs.1 lakh for a period of one year without paying anything other than card a one-time fee of Rs. 707. Along with this, customers can enjoy discount offers from pharmacies and diagnostic centres on using the card. For instance, currently, customers can enjoy 25% off at Apollo pharmacies, up to 20% off on Metropolis Labs' diagnostic tests and a flat discount of 30% at Medlife.

All in all, the Digital Health EMI Network Card offers great value for money, making finance one less thing to worry about when it comes to healthcare. To get started with a customized EMI financing deal, customers can check their pre-approved offer today.

All in all, the Digital Health EMI Network Card offers great value for money, making finance one less thing to worry about when it comes to healthcare. To get started with a customized EMI financing deal, customers can check their pre-approved offer today.

.jpeg)

.jpeg)

.jpg)

.jpg)