The fundamental purpose of health care is to enhance the quality of life by enhancing health. Medical care probably constitutes only 10% – 20% of health outcomes. Health care is a much broader idea of which medical care is only a subset and constitutes the remaining 80-90% of health outcomes

Mayur Sirdesai, Partner/ Founder, Somerset Indus Capital Partners has over 25 years of experience in Healthcare/ Pharma and FMCG and has worked in various roles and has also mentored several healthcare entrepreneurs. He has been in the Private Equity space for the last 8 years.

Somerset Indus Capital Partners is a Healthcare focused PE fund that has a strong track record of making several successful investments across Pharma, Life sciences, Medical Technology, Diagnostic Products and Services, Healthcare Delivery, Primary Care, Nutrition, and Wellness.

An investment strategy in the healthcare sector

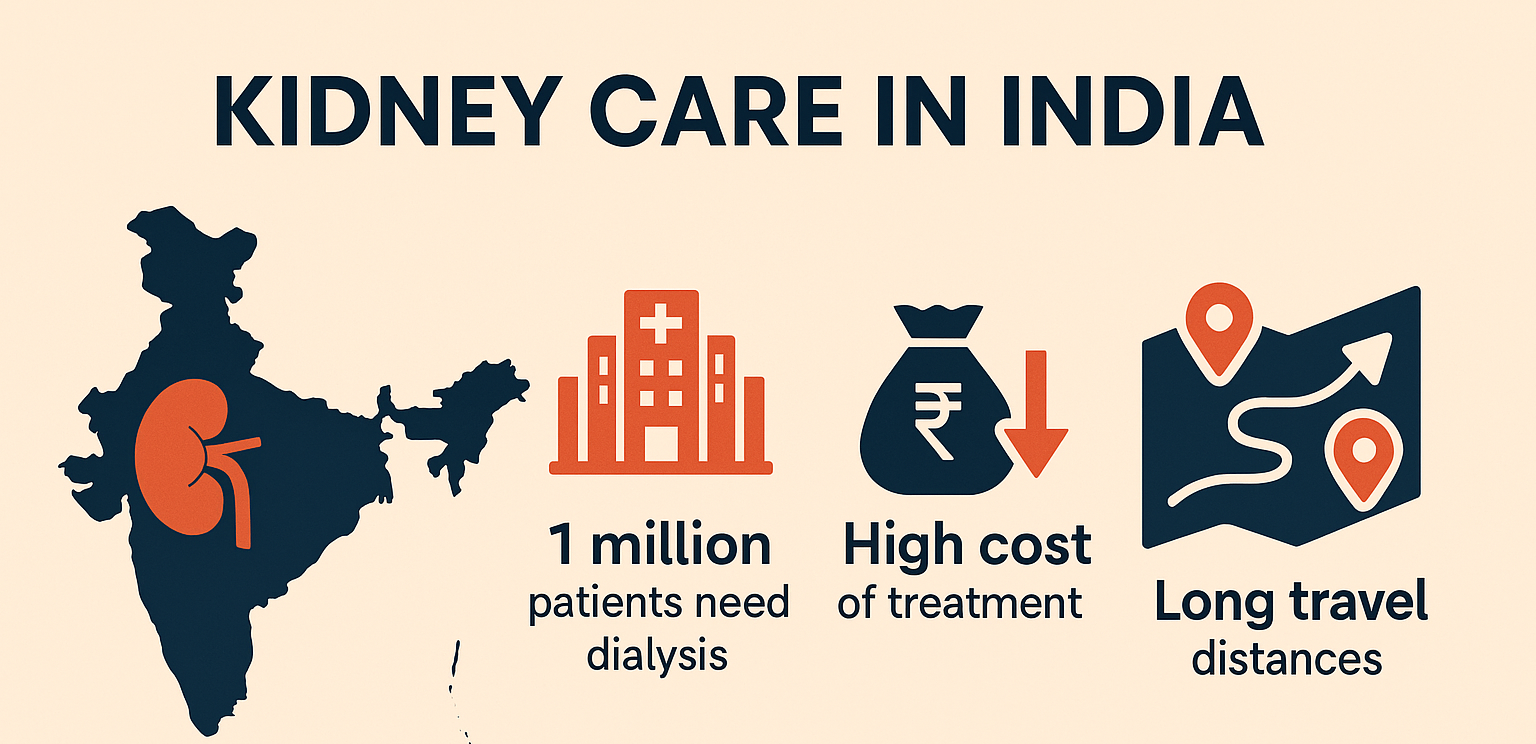

Mayur throws light on the genesis of Somerset Indus Capital Partners, “Healthcare capital is a private equity fund focused on the early growth stage of investing in Healthcare. This was founded by me and my childhood friend Avinash Kinkare. Avinash has been in private equity – healthcare, Europe for 25 years while my background has been more in the operations, advisory, and consulting in pharma and healthcare in India. In 2010 Avinash came back to India and we actually looked at operating businesses to build out in healthcare so we looked at things like hospitals, clinics, dialysis clinics, etc. and as we kept looking at the sector, we realized that there are many promoters out there in the SME sector in healthcare who are building good businesses, strong backgrounds, but they were struggling to scale up businesses for two reasons. One was lack of capital, in those days when we started in 2012 something in the range of 25-30 crore banks wouldn't give. Private equities were looking at larger cheques. We thought this was a sweet spot so we decided that this is something which we could look at. Also, we realized, to scale up requires support and in terms of management strategies so instead of us building something, why not support entrepreneurs who were doing that. So that's how we created the fund. Typically most of our investments are focused on Tier 2 looking at sustainable impact. So that is where we come from, and I think that's been a motto, but also work with promoters to build the company and we put our entire bandwidth behind them to build it.” he says.

Strong network across the Indian healthcare sector with over 25 years of experience

Mayur talks about his journey in the healthcare industry, “In terms of education I'm a chemical engineer from IIT Bombay, but my family background has been healthcare - pharma and that's where it started out. Ever since I got in the professional field I've worked across different domains both at MNC's and Indian companies along with running my own family business in Pharmaceuticals. Built a large contract manufacturing organization to build pharma plants, run them, and run marketing sales. I actually built IMS Health which is 1 of India's larger healthcare consulting companies. I built that business pretty much from scratch. And so I've got experience across domains in pharma and healthcare, whether it is manufacturing, marketing, consulting, I-banking. So when Avinash and I sort of came together, I think it just sort of happened and it's been a good journey. I think the whole space of working in pharma and healthcare across must have given me a fairly large network to work with and that does make a big difference when you sort of invest because when you look at promoters and investing, it's important to understand them well. I think I've lived in that space for a decade so I understand what promoters need and it allows us to be fair to them both in terms of as investors as well as support them wherever required,” he says.

Healthcare is a very large sector

Mayur talks on healthcare sectors that would evolve in the coming decades, “So I think Healthcare is always being a sector of choice when, when things are not the best. I think it's always been a defensive sector so it's a sector that never goes off for the negative. I think it's always good to invest. I think in today's times probably it's more in focus because of the pandemic and it creates more challenges to address. I think healthcare if I had to divide it in the Indian context. There are some sectors which are mature, some sectors which are growing, and I think some sectors which pandemic have sort of fast-forwarded. So if I have to take mature sectors, I think pharma and Life Sciences is a very mature sector. It's a very large sector. I think today that sector is dominated by the big boys. I think it's no longer something which new entrants can sort of make but even it has gone through its own sort of dynamics over the last two-three years based on the regulated market side with the USA,” he says.

Upcoming healthcare sectors in India

Mayur presents his thoughts, “I think that the whole sector is coming out of age and I see great opportunity. I mean in the last few months you've seen huge investments being made in the pharma sector. India is still a Metro Tier 1 market for health care but I think there's a huge market in the lower tier markets to cover and with our government coming up with Ayushman Bharat so probably healthcare in terms of people, probably it's doubling in the number of people it probably covers or more. But again I think that Tier 2 hospitals, Tier 2 clinics, specialty clinics, etc, as another sort of sector, which is sort of coming of age. One sector which is really coming of age is the diagnostic center, this being due to COVID testing, screenings, etc. Going forward, diagnostic products, point of care, molecular diagnostics will be coming up. I think Med-tech, we believe with the whole advent of the healthcare infrastructure being built out. We believe that another sector which will really pick up is nutrition and wellness. I think India with health insurance now picking up, also Ayushman Bharat coming in, that whole space of preventive care, primary care, nutrition, Wellness all this is sort of coming of age and I think COVID has expanded that further because of things like digital health, people's focus on immunity, nutrition, all that which has increased. The new sectors which are opened up for the sub-sectors are molecular diagnostics, digital health, nutrition, biopharma. So I think it's a really good time to be in healthcare right now. I think there are so many sectors in so many opportunities to pick out. I think there is really the ability to build but saying so I think in India it is what really wins is execution. So I think even now the whole story still remains the same. That person who can execute deeper and faster is the guy who wins. So I think that story still holds true and that's where we are,” he says.

More innovation happening in India as compared to other parts of the world

Mayur talks about his experience of being involved in the Healthcare startup space as a mentor, an Investment Committee member of IIT Bombay Incubators like SINE and BeTIC as well as an Expert of the BIRAC BIG Grant evaluation committee, “I think from my experience of working with BIRAC, which is the government incubator in biotech and Med-tech as well as with being alumni from IIT Bombay, I have access and I should have worked with the incubators there. I think what we see now across the board here in healthcare innovation is not a challenge anymore. We see more innovation happening in India as compared to other parts of the world but the big challenge we still see is the lack of funding. The government through BIRAC does a lot to start funding, typically it gives the 50 lacs – 1 crore kinds of runs which is really a good starting point. Funding that is required is missing in India and I think that is something which we are really looking at and trying to create an ecosystem around because that is where innovations go through the valley of death. And we see that happening more often than not that people just can't find enough investment. You will have family offices do it, one of you will have some other big corporate do it, but you don't have too many institutionalized funds in India which do sort of a startup investment where you're moving from proof of concept to commercial scale,” he says.

The intent is to create an ecosystem around healthcare innovations

Mayur throws light on the matter, “In healthcare, there is always a lag because healthcare has issues related to clinical trials, regulatory approvals, etc so it takes a lot of time, investors don't have the patience to work in that space. And I think that is the whole challenge which we face so the intent is to create an ecosystem around so one of the things which we do as a fund is we typically invest in services and product platforms which have access to customers, another will have access to 3000 hospitals so any startup wants to build something and you want to do a proof of concept with Hospitals or clinics or with some other customers please use our platforms. Maybe we'll work some way out by which both companies have a win-win where you really don't need to invest. It is not a question of investment in terms of actual cash, it is an investment in kind also which helps quite a bit in terms of actually laying out a network where people can work and I think that that is something which we believe truly works to build that ecosystem because, on the other side, large Indian companies are also hungry for more products and an Indian innovation there is a sort of inbuilt factor of meeting the right price point. If you go to the West and say I want innovation, their price points are very different. So Indian innovation actually has that advantage but getting it to the point where a commercial organization can bring it on board. I think that is the gap which you need to sort of work,” he says.

The startup ecosystem in India

Mayur throws light on the subject, “So I think it's across the board. I mean between US partners we have four partners in the Fund. I think we do get a fair bit in terms of startups, etc. I mean it could be the incubators we work, through sort of meetings or webinars. We serve a tent. I mean our intent is to invest in them because that's not our mandate. But I think we believe that we have to support the sequel system. So whatever we get on board with which we feel can work either it's our portfolio companies or to other private equity funds which we have, which we know we will always make up. Make a point to connect them because we believe that it's important to build the healthcare ecosystem and you know the startup ecosystem in India. The next wave will come from these kinds of innovators, so it is not something that can be ignored. I think it's something which we need to coexist with and evolve,” he says.

Post-COVID, India is in all the sectors of healthcare

Mayur presents his views, “We are bullish on pretty much all the sectors of healthcare, right? I think more so now with COVID. I think India has a lot to teach the rest of the world. Investors and companies are on board to understand how Indian companies address these issues. So I think that the market is there to sort of evolving with, what sectors you pick up will be important. I believe we can help create a sustainable impact and that is what our sort of theme is. We are not an impact fund but we by default have been going to the lower tier markets because we believe that unless you have somebody who can build a profitable business and serve the masses, I think this is the story in India. If I have to look at India and say India V/S Bharat, the India story is the metro tier 1 story, and a lot of people know how to play. Going that lower tier is a different mindset and we like supporting promoters who go there and it creates a different business and it really impacts. that is probably looking forward to if we go forward building this fund house and leave a mark on can we really build companies in India that can serve other markets so that is where we want to make our marks,” he says.

(Edited by Rabia Mistry Mulla)

“That person who can execute deeper and faster is the guy who wins. So I think that story still holds true and that's where we are,†says Mayur Sirdesai, Partner/ Founder, Somerset Indus Capital Partners.

“That person who can execute deeper and faster is the guy who wins. So I think that story still holds true and that's where we are,†says Mayur Sirdesai, Partner/ Founder, Somerset Indus Capital Partners.

.jpeg)

.jpeg)

.jpeg)

.jpeg)