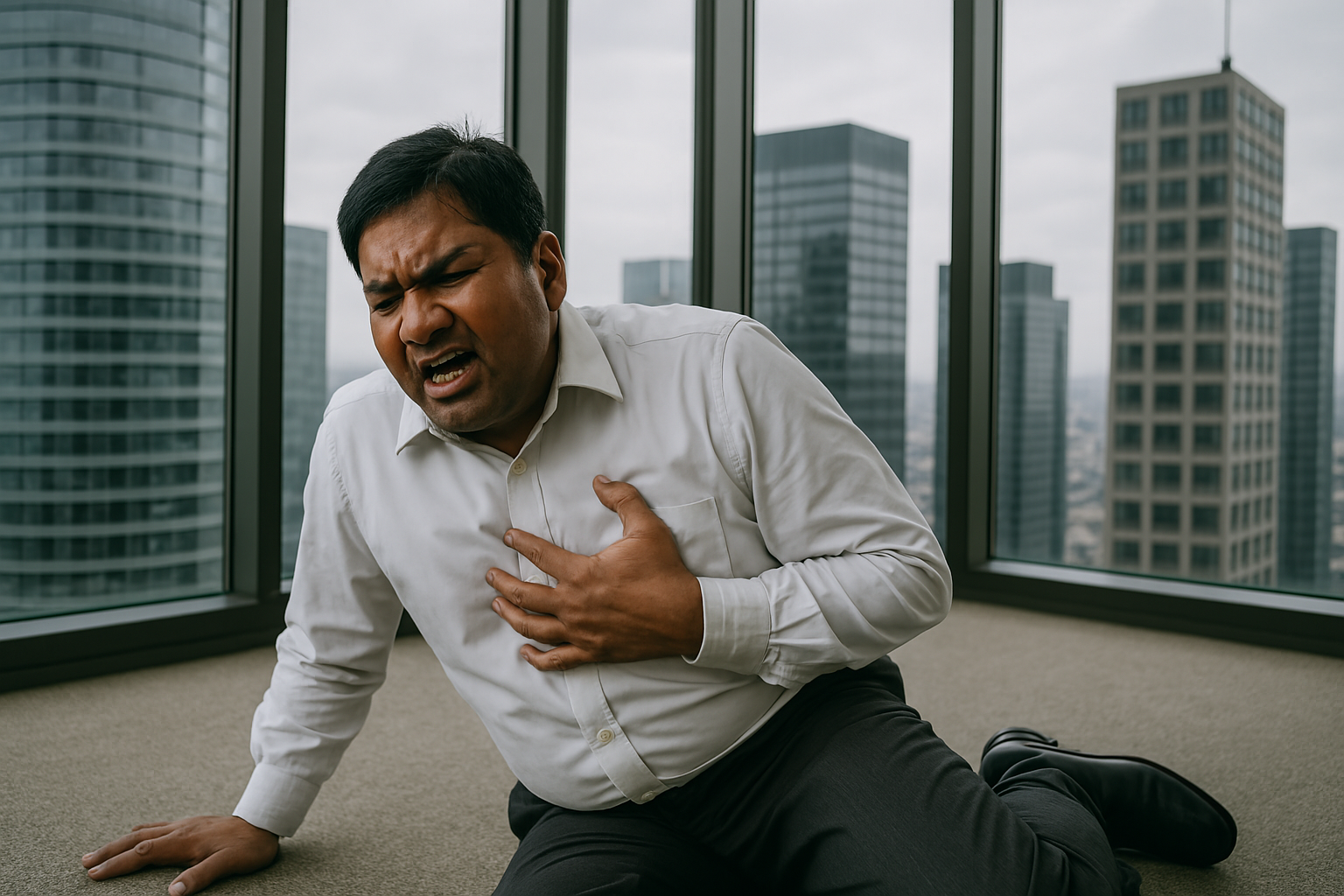

For years, senior citizens in India have faced an uphill battle when it comes to health insurance. With skyrocketing premiums, many elderly individuals found themselves struggling to maintain their policies or were forced to forgo health insurance altogether. However, a major decision by the Insurance Regulatory and Development Authority of India (IRDAI) is set to change the landscape of senior citizen healthcare coverage.

In a decisive move, IRDAI has put an end to unchecked premium hikes for senior citizens, ensuring that health insurance remains accessible and affordable. The new directive caps annual premium increases at 10%, providing much-needed relief to elderly policyholders who have long suffered from exorbitant price surges.

Why This Decision Was Necessary

Health insurance is not a luxury, it is a necessity, especially for senior citizens who often face higher medical expenses due to age-related health issues. Over the years, insurance companies have been imposing steep premium hikes, sometimes as high as 60-80%, making it nearly impossible for many elderly individuals to continue their coverage. In some cases, premiums were even doubled, forcing retirees and pensioners to dig deep into their savings just to afford healthcare.

The situation had become untenable, leading to numerous complaints from policyholders and consumer rights groups. IRDAI’s intervention is a direct response to these grievances, ensuring that senior citizens are not subjected to arbitrary and unsustainable cost increases.

Under IRDAI’s latest directive, insurance companies must now adhere to strict guidelines when it comes to increasing premiums for senior citizen policies.

1. Premium Hike Cap at 10%: Insurance providers cannot raise premiums for senior citizens by more than 10% in a single year. Any increase beyond this limit requires approval from IRDAI.

2. Mandatory Regulatory Approval for Higher Increases: If an insurer wants to impose a hike beyond the 10% cap, they must submit a formal application to IRDAI. The regulator will assess the request and determine if the increase is justified. Only if the proposed hike is deemed reasonable will IRDAI grant permission for a higher adjustment.

3. Protection Against Policy Discontinuation: Insurance companies can no longer withdraw individual health insurance products designed specifically for senior citizens. This prevents insurers from phasing out plans and forcing elderly policyholders to look for new coverage at higher rates.

4. Standardized Hospital Empanelment & Pricing: IRDAI has directed insurers to collaborate on creating a common network of hospitals. Standardized healthcare packages will be negotiated to ensure fair pricing for senior citizen treatments. This move aims to eliminate price discrepancies and ensure that elderly policyholders receive uniform coverage benefits across different insurers.

This landmark decision by IRDAI is a game-changer for senior citizens in India. Here’s how it will help:

1. Stability and Predictability: Senior citizens will no longer be blindsided by sudden, excessive premium hikes. A 10% cap ensures gradual increases, making it easier for policyholders to plan their finances.

2. Affordability of Health Insurance: Many elderly individuals were forced to let go of their health insurance due to unaffordable premium hikes. With this cap, they can now continue their coverage without financial distress.

3. Protection from Policy Discontinuation: Some insurers previously withdrew senior citizen-specific plans, leaving policyholders stranded. The new rules ensure that these policies remain available, preventing insurers from abandoning their elderly customers.

4. Greater Transparency & Accountability: Insurers can no longer impose arbitrary hikes without regulatory oversight. The need for IRDAI approval creates a check against unfair pricing practices.

5. Improved Access to Healthcare: Standardized hospital empanelment will make it easier for senior citizens to find hospitals covered under their insurance plans. Negotiated packages mean more cost-effective treatment options for elderly policyholders.

IRDAI’s decision is more than just a rule change, it represents a shift in how the insurance industry treats senior citizens. Historically, elderly policyholders were often considered “high-risk” and were subject to aggressive premium increases or policy exclusions. This regulatory intervention signals that the government is committed to protecting the rights of senior citizens and ensuring fair treatment in the insurance sector.

This move also aligns with a broader vision of making healthcare accessible and affordable for all age groups. With India’s aging population on the rise, health insurance is set to become even more critical in the coming years. By regulating premium hikes, IRDAI has taken a crucial step in safeguarding the financial security and well-being of elderly citizens.

What Should Senior Citizens Do Now?

For those already holding health insurance policies, this is great news. However, it is important to stay informed and proactive. Here are some steps senior citizens can take:

1. Review Your Policy: Check your renewal documents to ensure that any premium hikes are within the new 10% limit.

2. Report Violations: If an insurance company imposes a hike beyond the permissible limit without IRDAI approval, complain with the regulator.

3. Compare Plans: With policy withdrawal now restricted, consider exploring different insurers to find the best coverage at reasonable rates.

4. Stay Updated: Keep an eye on future IRDAI announcements regarding senior citizen health insurance policies.

While this is a significant victory for elderly policyholders, there is still room for improvement. Many senior citizens struggle with claim rejections, co-payment clauses, and long waiting periods for pre-existing conditions. Further reforms could focus on simplifying claims, reducing out-of-pocket expenses, and ensuring better customer service for elderly insurance holders.

For now, IRDAI’s decision brings a sigh of relief to thousands of senior citizens who can now hold on to their health insurance without the fear of unreasonable premium hikes. This regulatory move is a step in the right direction, reinforcing the principle that healthcare should be accessible and fair for all, regardless of age.

The road ahead may still have challenges, but with continued advocacy and policy interventions, India is gradually moving toward a more inclusive and equitable health insurance system for its senior citizens.

This regulatory move is a step in the right direction, reinforcing the principle that healthcare should be accessible and fair for all, regardless of age.

This regulatory move is a step in the right direction, reinforcing the principle that healthcare should be accessible and fair for all, regardless of age.

.png)

.png)

.jpeg)

.jpeg)

.jpg)

.jpg)