While working for Facebook in The USA, Saurabh Arora came back to India for a vacation. Here, he happened to visit a chemist and was shocked to see how many people were buying self-prescribed or chemist-prescribed medicines. He knew the danger of buying medicines without the doctor’s consultation. He understood how hazardous the consequences of unprescribed medicines could be. Yet the prevalence of not consulting a doctor was common and rampant in India.

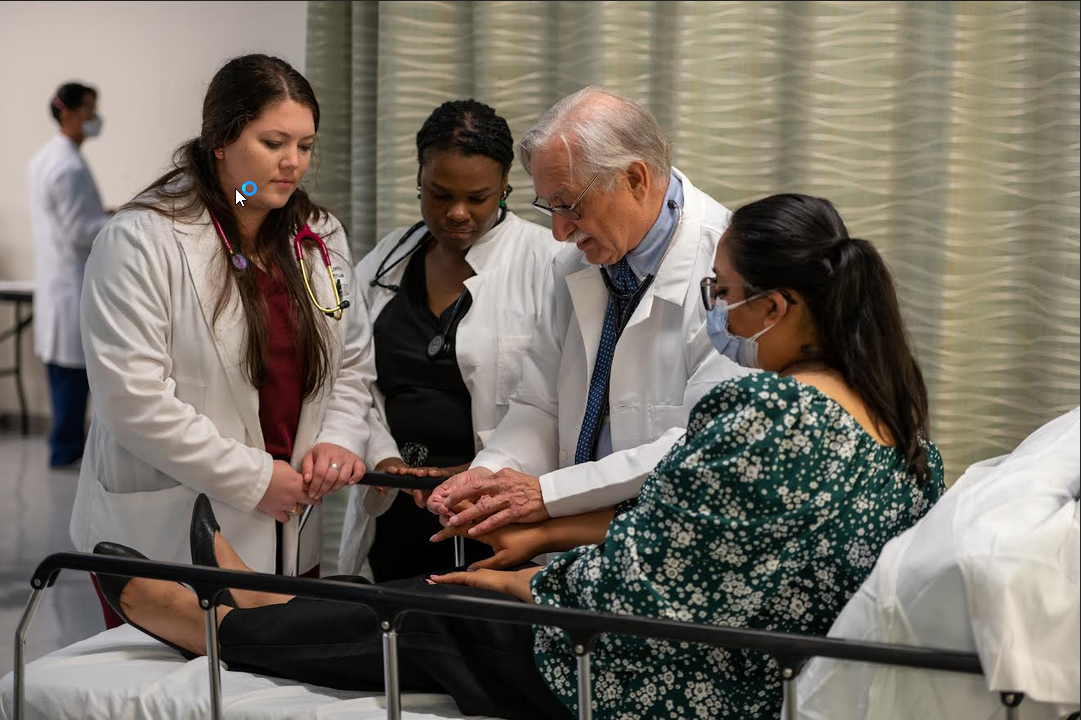

So he decided to quit his job back in the States and start a venture with former Snapdeal employee Rahul Narang. They started Lybrate in 2013, which connected doctors and patients through one’s mobile. They wanted to make the activity of getting medicines smoother and ease filled. The telecommunication platform saw instant success. In the first half of 2015, it had 80,000 doctors with various specialisations and 1 lakh patients visiting every day.

It rewrote the rules of investment of that time. In 2015, only 2% of investors’ capital would reach healthcare startups. But Lybrate attracted funding pretty easily despite investors' previous hesitation. It became India’s first institutionally funded teleconsultation startup. In 2014, they earned $1.2 million. The next year, they raised $10.2 million in their series A round. This round saw participation from Nexus Venture Partners, Tiger Global Management and Ratan Tata, Chairman Emeritus of Tata Sons. Their last funding round was in 2017, where Nexus helped raise $3 million in funds. They raised a total of $14.4 million in 3 funding rounds.

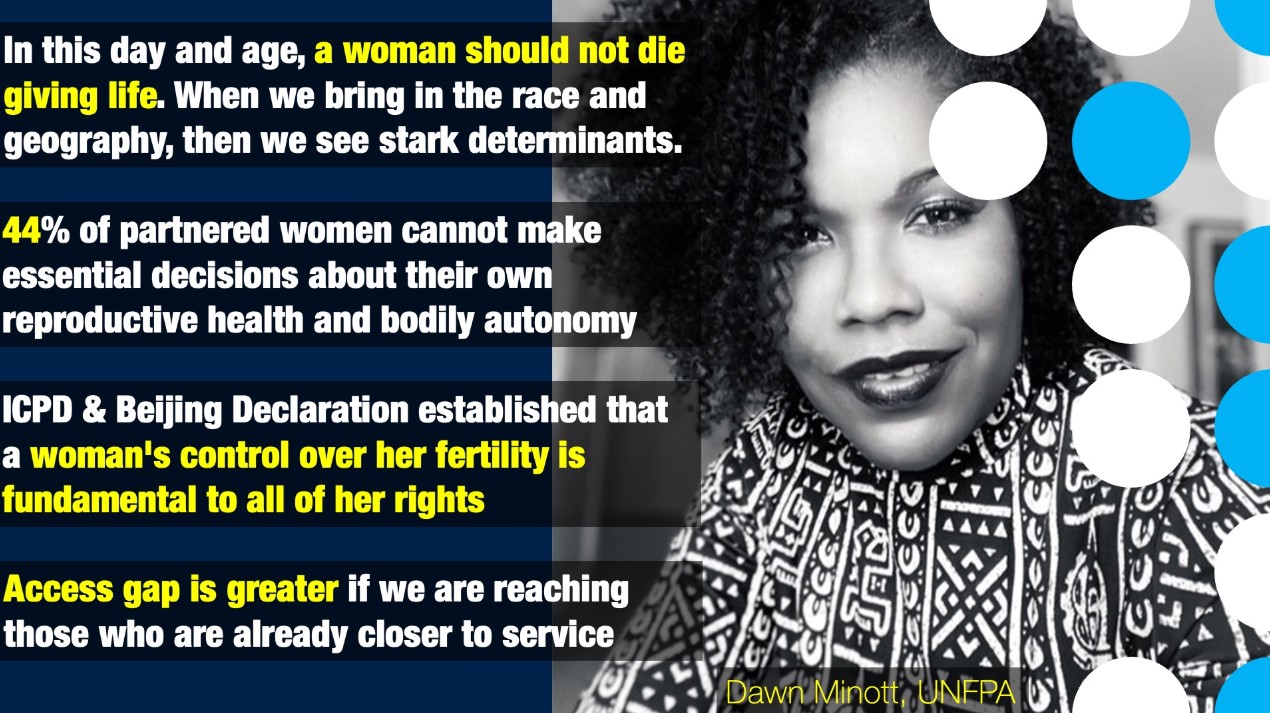

In 2015, Lybrate worked as a digital partner for Indian Medical Association and in May 2016, they launched Lybrate Lab+. This was an online lab service that allowed patients to give their samples from their homes and get results delivered to them. By 2019, Lybrate’s turnover for the year was Rs 22.45 crores. 60% of its customers came from tier 1 cities and the rest from tier 2 and tier 3 together. According to Quadria Capital, 70% of Indians live in rural areas where only 37% have access to inpatient care.

Will Lybrate be able to penetrate deeper into the market by strategising to capture the rural market? Especially when acceptance of teleconsultation has increased since the Covid induced pandemic?

According to Quadria Capital, 70% of Indians live in rural areas where only 37% have access to inpatient care. Will Lybrate, a teleconsultation platform, bridge the unequal gap in India's healthcare?

According to Quadria Capital, 70% of Indians live in rural areas where only 37% have access to inpatient care. Will Lybrate, a teleconsultation platform, bridge the unequal gap in India's healthcare?

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)