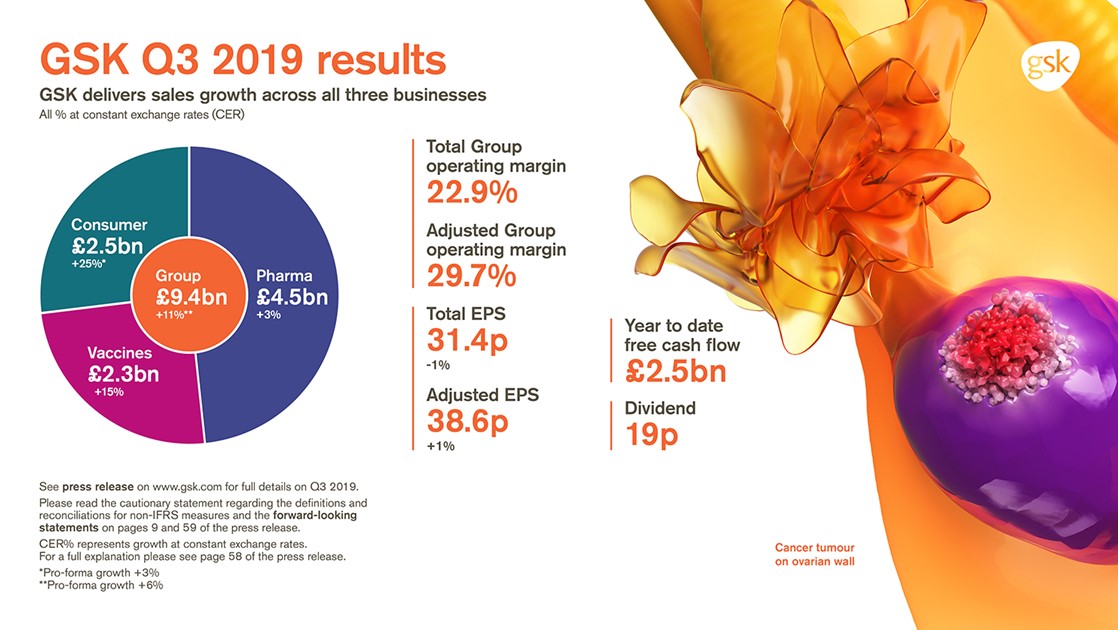

Recently GSK released their Q3 performance numbers for the investors. Financial highlights Reported Group sales £9.4 billion +16% AER, +11% CER (Pro-forma growth +6% CER*); Pharmaceuticals £4.5 billion +7% AER, +3% CER; Vaccines £2.3 billion +20% AER, +15% CER; Consumer Healthcare

£2.5 billion +30% AER, +25% CER (Pro-forma growth +3% CER*) Total Group operating margin 22.9%; Adjusted Group operating margin 29.7% reflecting increased spending on R&D and priority assets, and the impact of generic Advair in the US, partly offset by Vaccines performance (Pharmaceuticals 24.1%; Vaccines 50.3%; Consumer Healthcare 24.3%) Total EPS 31.4p +9% AER, -1% CER, Adjusted EPS 38.6p +9% AER, +1% CER reflecting operating performance and lower effective tax rate offset by increased profit allocation to non-controlling interests 9 months net cash flow from operations £4.6 billion. Free cash flow £2.5 billion 19p dividend declared for the quarter, continue to expect 80p for FY19 Consumer Healthcare JV with Pfizer completed 31 July creating new world leader in Consumer Healthcare 2019 Adjusted EPS guidance improved to expectation of around flat at CER from a decline of -3% to -5%

GSK Q3 performance

GSK Q3 performance

.jpeg)

.jpeg)

.jpg)

.png)